Amadeus already fortified its sales presence as the leading leisure travel sales platform in Germany with the 2006 acquisition of TravelTainment (the primary leisure travel internet booking engine in Germany) and is now yet again adding to its suit of products another corporate booking tool (Cytric) right next to their own corporate booking tool, E-Travel (which is also supported by PASS Consulting’s XX/1).

This acquisition is definitely giving a boost to the sales side of Amadeus, increasing a feel of oligopoly the GDSs already share in, within the travel industry in which Amadeus is one of the largest players. It seems that there is hardly any competition left apart from the other major GDSs. Amadeus already holds a worldwide market share of agency air bookings of up to 40% (compared to Sabre’s 26% and Travelport’s 25%) and a market share within EMEA of up to currently 63% with air distribution contracts with the likes of Lufthansa, Air France, Iberia, British Airways or Quantas. In the US, they currently hold a 14% market share and they are steadily gaining. Also since signing a deal with Expedia two years ago, Amadeus boosted its footprint in the US significantly.

Amadeus challenging other GDSs

Amadeus will definitely try to challenge the other GDSs in the US market and solidify their dominant role in Europe with no actual competition around. The deal, though, is yet to be finalized and the acquisition is contingent on German regulatory and iFAO shareholder approvals.

Now after Sabre’s much hyped IPO in April, it might be Sabre’s turn to look for adequate investments on the IT market and travel sector. Sabre might have now the means to do so, even if they said that the money from the IPO would mainly be used to pay off debt and settle fees, it is never only about that. The GDSs know about their status and are trying to solidify that position in the travel market by buying into competing technology and/or trying to silence them by buying them out. Sometimes even creating hurdles for other tech companies or suppliers to enter the market due to their singular position and power. It will be interesting to see, what Sabre will have up their sleeves.

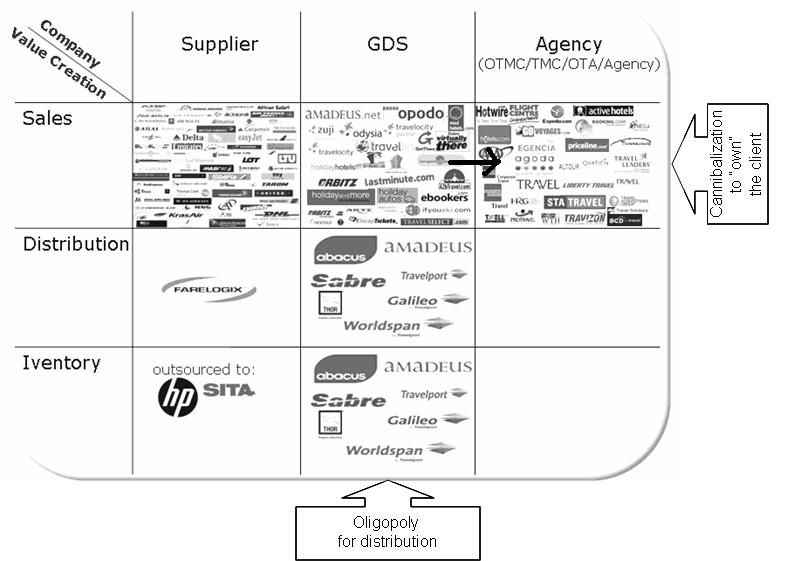

In my book “Value Creation in Travel Distribution”, I specifically discussed how the GDSs are dominating the market position for sales, distribution and inventory within the travel industry by making booking tools available to agencies and TMCs while at the same time operating their own OTAs and OTMCs and thus competing directly with agencies as well as by controlling which technology companies are granted access and which are not, thus creating an environment of oligopoly.

The below illustration shows which companies are active in which segment of the value chain: The rows represent the added value (supplier inventory, distribution and sales); the columns indicate which companies are represented by what subsidiaries in the various areas of value creation.

The bottom line is the GDSs are in a fierce competition with everyone, as well as with each other that tries to circumvent them claiming to have the best solution. Whereas in reality travelers and businesses pay a significant amount for GDS distribution which modern technology firms claim to be able to offer at a fraction of that cost. Also look at the now famous example of the lawsuit of American Airlines versus Sabre, with AA trying to cut loose from the almighty GDS.As I had already discussed in previous blogs the travel industry is in need of innovation. If innovation is absorbed by the big players or doesn’t stand a chance of creating a nameable competition, the market will stay the same.

Image by EDHAR