Google Analytics suggests that the most read article on this blog is “The difference between CRS and GDS”. This tells me that there is a need to educate about travel players and their interactions, travel technology and travel business models. I would therefore like to start a new series under the name: Travel Technology for Dummies

Blog Series: Travel Technology for Dummies

- What Is Full Content?

- What Is a Booking Reference or PNR?

- What Is Overbooking?

- What Is a Passenger Service System (PSS)?

- What Are Booking, Waitlists, Tickets, Codeshare & Interlining?

- What Are Active and Passive Segments?

- What Are Incentives, Commissions & Overrides?

- What Is a ‘Married Segment’?

- Blockchain in Travel: All You Need to Know – for Now

- What Is the Difference Between Fares, Rates and Tariffs?

- What Is NDC?

- What Is Continuous Pricing?

- What Is Direct vs. Indirect Distribution?

What Does Full Content Actually Mean?

Since the legal dispute between US Airways and Sabre, we hear “full content” everywhere. After the verdict, where a jury decided among other things that methods of the GDSs (Sabre) to force airlines into full content agreements are unlawful, a number of airlines (among them American, Air Canada, JetBlue, Lufthansa Group, United Airlines, Alaska Airlines, and Virgin America) now try to enforce this verdict in order to get better deals. All this can be read in other blog posts I wrote or e.g. on The Beat [paywall] or The Company Dime [paywall]. But the question becomes: What does full content actually mean?

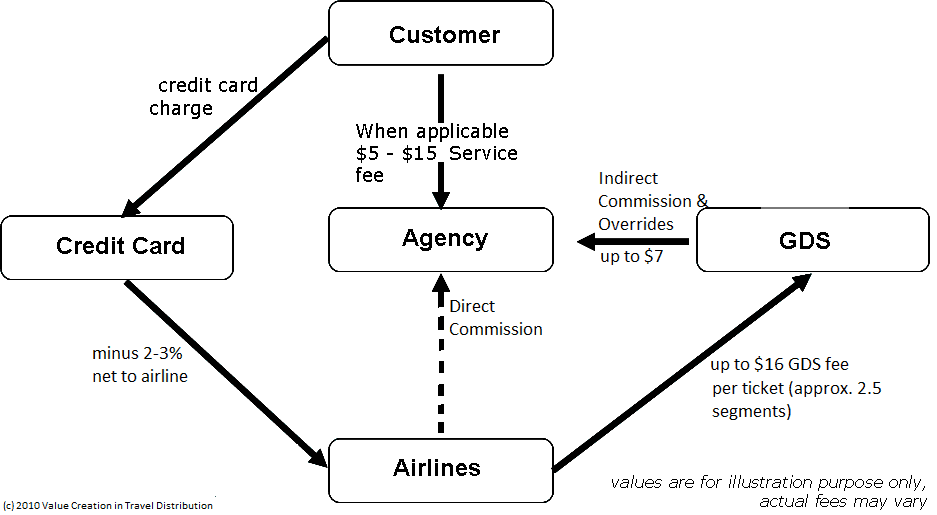

The term “full content agreement” refers to a clause in the contract between an airline and a Global Distribution System (GDS) which obligates the airline to distribute all of its fares via the GDS. It may point to a “Most Favored Nation (MFN)” clause as well as a “content parity” or “full content” provision in agreements between carriers and GDSs. GDSs and airlines enter into agreements via a common contract form called PCA (Participating Carrier Agreement). “Full content” in essence means that in order to pay less for distribution in certain markets, the airline agrees to provide the same content via a GDS as it does down any other channel, including its own – such as its website or call center. Those distribution fees can go down to $ 1.35 and average around $ 4.29 per segment in North America. If an airline violates such agreement, the fees are likely to go up – how much is a big question mark and other factors play in – including but not limited to parity provisions that deny airlines the flexibility to work in order to expand and enhance their partnerships with other lower-cost GDSs.

All Offers in One Spot? Full Transparency – the Suppliers’ Nightmare!

In an ideal world from a consumer perspective, if a GDS has full content agreements with all airlines, treats all airlines equally and has no technical flaws in the system, consumers should find the completed offer in one spot – meaning they should see all airlines being treated equally based on cost, departure/arrival, duration, class of services, availability, stops, etc. No shopping around necessary. But we all know that this is not the case. Why? My simple understanding is: Airlines need to compete one another and distinguish themselves. How can they do that if the consumer experience is broken down to a seat? The same applies to GDSs: they may earn more in booking fees if they prefer the sale of a certain airline. However, why exactly this is not the case is for social economists to explain. I want to explain what terms float around and how the travel industry works in reality rather than picturing myself in an ideal world which will never happen.

Airlines pay GDSs for distribution – so-called commissions and overrides.

The numbers are floating around $ 16 per ticket. Lufthansa supposedly pays such premium or even more and recovers such fee from their travelers by charging them € 16 (around € 2 – € 3 costs for their own distribution). However, it is assumed that their cost is (only) around € 19 because their alternative distribution channel is their own website or Farelogix, both of which Lufthansa does not view as a GDS under their “parity and no surcharge provisions” that apply to GDSs but not to direct distribution channels. In other words, they have to treat all GDSs equal and cannot prefer one GDS over another, but they are “allowed” (although at a higher fee) to distribute through channels not considered Global Distribution Systems. A view that is currently challenged by Sabre in another lawsuit pending in Texas [paywall], where Sabre very well considers Lufthansa’s own website and Farelogix as GDSs per definition in their agreement. In addition, Sabre chose to start billing for passive segments in certain circumstances.

Is There a Chance to Get Out of the Claws?

With the Sabre verdict on the table, airlines are trying to get out the claws of the GDSs and be able to distribute freely via their preferred channels. Some may even opt to pay a premium for such freedom (like Lufthansa did). However, the cost per booking for a non-full-content deal is expected to be even significantly higher than $ 18. A non-full-content deal has most likely never been on the table and as GDSs will want to secure full content, it is likely that fees for those deals will be through the roof – unless of course a GDS sees value in having at least some fares from the respective airline in order to “improve” their service offering. An example for the latter would be the largest US domestic airline Southwest that only a few years ago offered to distribute some fares through the GDSs. So for an airline to distribute freely, there is a cost to it which probably defeats the whole benefits. As many of these deals are up for renewal, airlines seek “legal clarity” on the above mentioned jury verdict in order to improve new contracts currently being negotiated. Clear guidance from the court stating that Sabre’s full content provisions are unlawful and unenforceable would allow the airline industry to charge in accordance with actual costs and benefits and “lower the cost of air travel in the United States… [and] also spur innovation”.

This is what happens when everybody puts their eggs into three baskets worldwide. As I wrote in my book in 2010: an oligopoly with no real competition means that a referee needs to step in.

Picture credit: Shutterstock

This Post Has 2 Comments

[…] want to get a piece of the pie. It is also a big gamble as the minute airlines and GDSs agree on full content deals and hooking the pipe into the NDC pipeline all this goes away. And, it seems to be a battlefield. […]

[…] who has been using Farelogix with the goal to achieve a better negotiating position and to escape full content and content parity agreements is now trapped between the claws of two GDSs: Sabre NDC on the API side and Amadeus […]